For international sellers expanding into the U.S. and European markets, 2026 marks the end of the "Tax-Free Era."

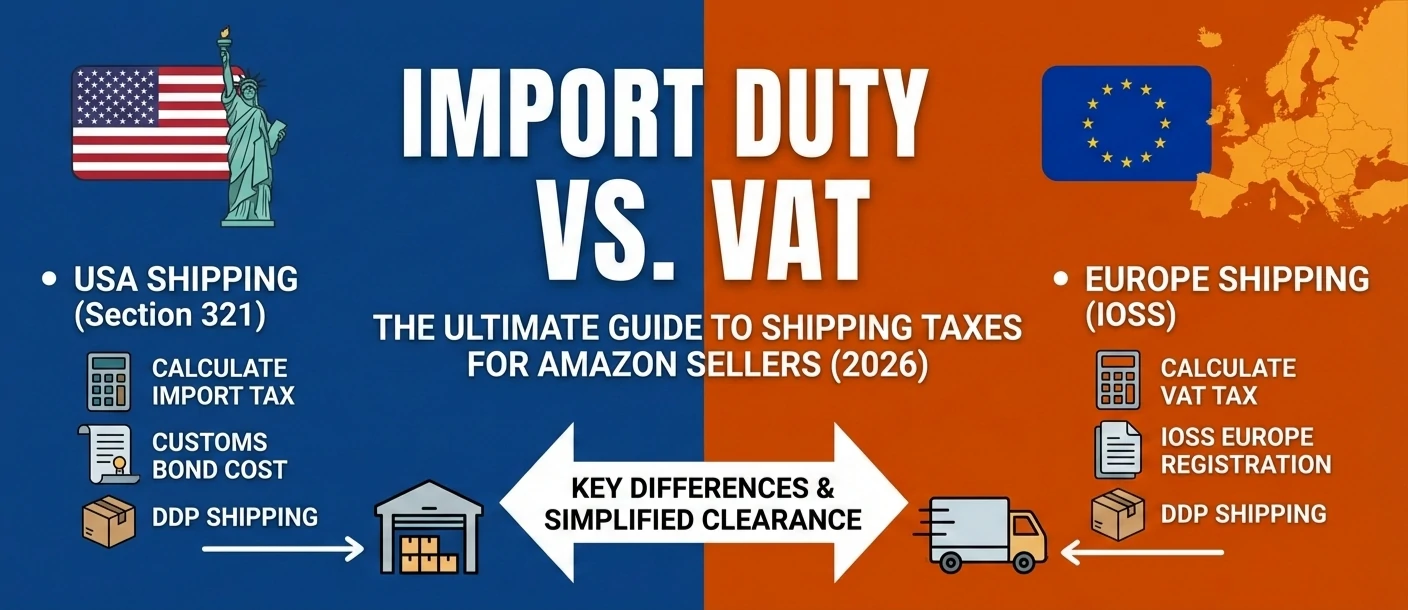

Logistics is no longer just about moving boxes; it is about protecting your profit margins. With the suspension of Section 321 exemptions for Chinese goods and stricter IOSS audits in Europe, a single miscalculation in your shipping taxes can wipe out your net profit overnight.

The confusion usually lies in the difference between the two main costs: Import Duty and VAT.

In this 2026 guide, we strip away the legal jargon. We will show you exactly how to calculate your Total Landed Cost, navigate the new US/EU policy changes, and explain why smart sellers are switching to DDP Shipping to automate compliance.

1. The Core Difference: "Entrance Fee" vs. "Consumption Tax"

Many beginners use "Duty" and "Tax" interchangeably, but mixing them up is a costly mistake. Think of them this way:

Import Duty (The "Entrance Fee")

What is it? A federal tax on the type of product you are importing (e.g., T-shirts vs. Electronics).

Purpose: To protect local industries. For example, Cotton T-shirts often face high duties (~16.5%) to protect US farmers , while Computer Accessories might be 0% to encourage tech growth.

Key Rule: Determined by your HS Code.

VAT (The "Consumption Tax")

What is it? A tax charged on the value added at every stage of the supply chain.

Who pays? Ultimately, the consumer pays this. However, as the importer, you often have to "front" this cost at the border before claiming it back (or collecting it via Amazon).

The Big Difference:

USA: Generally has NO Federal VAT on imports. (Sales Tax is collected later by Amazon).

Europe: Charges VAT on everything from the first dollar.

2. The Profit Formula: Calculating Your True Landed Cost

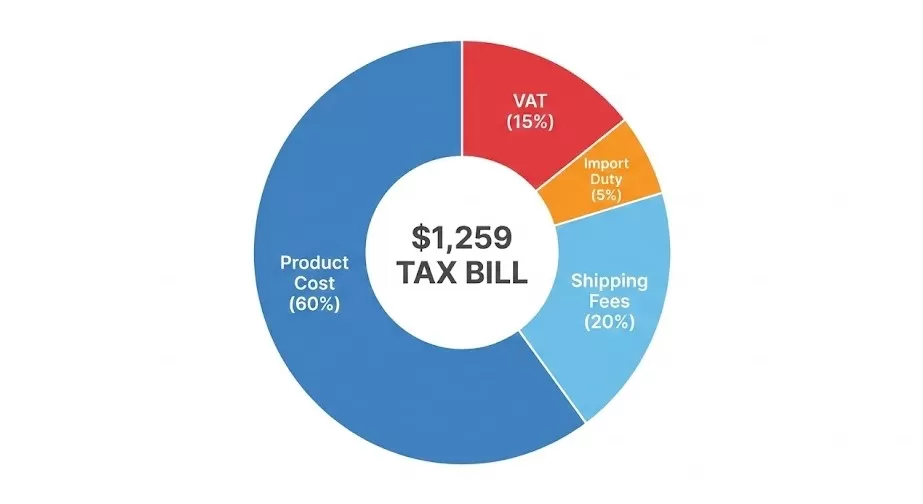

Calculating your landed cost is vital for profitability. A common rookie mistake is forgetting that in Europe, VAT is charged on the shipping cost too.

The Real-World Calculation

Scenario: You are shipping $5,000 worth of Headphones to Germany.

Shipping Cost: $1,000

Duty Rate: 2% (Assumption)

VAT Rate: 19% (Germany)

|

Cost Item

|

The Wrong Way (Ignoring Rules)

|

The Right Way (Actual Cost)

|

|

1. Duty (2%)

|

$100 ($5k × 2%)

|

$100 ($5k × 2%)

|

|

2. VAT Base

|

$5,000 (Product Only)

|

$6,100 ($5k Value + $100 Duty + $1k Shipping)

|

|

3. VAT (19%)

|

$950

|

$1,159 (Calculated on the Total Base)

|

|

Total Tax Bill

|

$1,050

|

$1,259

|

The Impact: If you calculated this wrong, you just lost $209 in profit on a single shipment.

3. 2026 Policy Alerts: What Has Changed?

Regulations have tightened globally. Here is what you need to know to avoid having your cargo held at the border.

Previously, shipments under $800 could enter the USA duty-free (Section 321).

The Change: As of May 2025, this exemption is suspended for goods from China.

What it Means: You can no longer avoid tariffs by splitting large orders into small packages.

The Bond Requirement: If your shipment value exceeds $2,500, you legally must purchase a Customs Bond.

One-time importer? A Single Entry Bond costs ~$50.

Frequent shipper? If you ship >5 times a year, a Continuous Bond (~$400/year) is cheaper.

Don't forget: You must also file the ISF Filing 24 hours before loading to avoid a $5,000 penalty.

Europe has removed the tax-free exemption. Now, all imports are subject to VAT.

The New Fixed Duty: Starting July 1, 2026, parcels under €150 will incur a €3 fixed duty per item (an interim measure).

IOSS (Import One-Stop Shop): For packages <€150, Amazon collects VAT at checkout. You must provide Amazon's IOSS Number to your forwarder.

Risk: Forget the IOSS number? Your customer gets charged VAT again at delivery -> Instant negative review.

Strategy: With the new €3 fixed cost, "cheap drop-shipping" is becoming expensive. We recommend consolidating shipments via Forest Leopard's Air Freight services to reduce per-item handling costs.

4. Common Pitfalls to Avoid

Even experienced sellers fall into these traps.

Mistake #1: Under-Declaring Value Declaring a $5,000 shipment as $500 might seem like a clever way to save tax.

Consequence: In 2026, customs digital audits can easily detect this. You risk cargo seizure, fines, and Amazon account suspension.

Mistake #2: Wrong HS Code Classifying a "Smart Watch" as a simple "Watch" vs. a "Radio Transmitter" drastically changes your duty rate.

Solution: Don't guess. Let our customs team classify your goods to find the lowest legal duty rate.

5. The Solution: Simplify Your Taxes with DDP Shipping

Understanding Import Duty vs. VAT is essential, but you don't have to become a tax accountant to sell globally.

The smartest way to handle this complexity is to use DDP (Delivered Duty Paid) Shipping.

Why Choose DDP?

Instead of hiring a broker, buying a bond, and paying three different tax bills, Forest Leopard offers a seamless solution:

One Simple Price: We quote you a flat rate per kg (e.g., $1.5/kg) that includes Shipping + Duty + VAT.

Zero Paperwork: We handle the HS codes, the bonds, and the customs clearance.

Faster Entry: Your goods arrive at Amazon FBA as if they were shipped domestically.

Ready to stop worrying about tax calculations? Focus on your sales and let us handle the borders.

[Get Your DDP Shipping Quote Now]

EN

EN

FR

FR

ES

ES

JA

JA

PT

PT

RU

RU

AR

AR